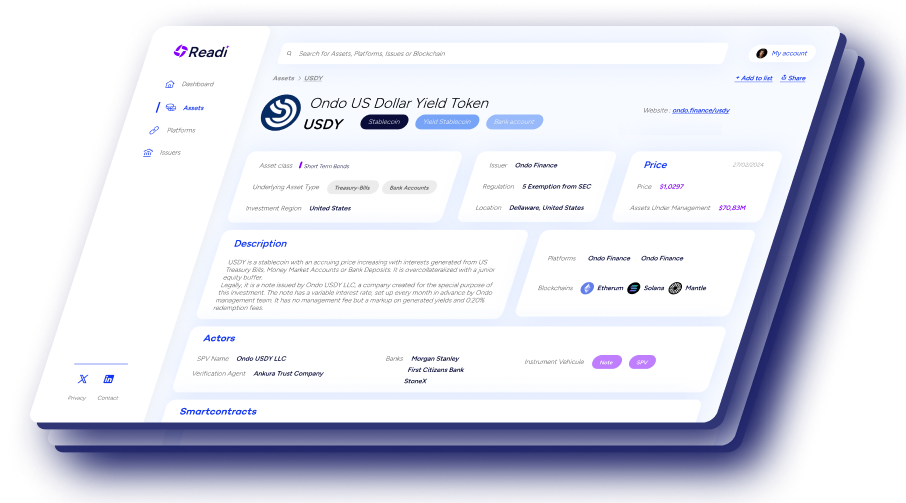

We provide detailed information about tokenized real world assets for investors

Access

Navigate the digital asset world with confidence

We created an exhaustive database of tokenized real world assets. Search for your next real world asset investment and get detailed information for your due diligence. Get to know the tokenization industry: discover the platforms, issuers, and tokenized assets. Compare their features and processes against your investment criteria.

ECB Expands DLT Settlement Initiative: A New Era for Digital Finance

The European Central Bank (ECB) is taking a decisive step towards integrating DLT-based transactions with a structured plan to enhance interoperability and security.

Read more >

What Are the Uses of DeFi? Smart Patrimoine

In a captivating intervention during the Smart Patrimoine show on B Smart 4 Change, Alexis Bourdillat, analyzed the challenges and opportunities of decentralized finance (DeFi) in Europe.

Read more >

The Evolution of Decentralized Finance

European financial supervisors ESMA and EBA have released a joint report outlining their observations on the recent developments in the Decentralized Finance (DeFi) markets

Read more >

European Central Bank Concludes Tokenization Testing Phase

The Eurosystem concludes a series of exploratory tests on the use of wholesale central bank digital currency in blockchain transactions of tokenized assets.

Read more >

Crypto Market Optimism Boosts Asset Tokenization

Is the tokenization of financial assets being driven by Bitcoin’s rise? The co-founder of Readi discusses recent developments on the Smart Patrimoine show.

Read more >

Tether launches Hadron, an Asset Tokenization Platform

Tether, the issuer of the world’s largest stablecoin, unveils a platform to "Tokenize Anything, Anywhere": Hadron.

Read more >

BlackRock Expands Tokenized Money Market Fund BUIDL Across New Blockchains

BlackRock's Money Market Fund BUIDL is integrated with five new blockchains: Aptos, Arbitrum, Avalanche, Optimism, and Polygon.

Read more >

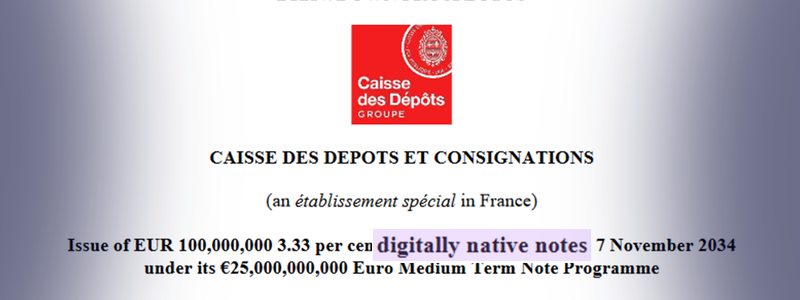

Caisse des Dépôts: France First Tokenized Bond in Digital Euro

The Caisse des Dépôts has issued a tokenized bond, settled in central bank digital currency. Banque de France created this euro token, which is also used in the Netherlands.

Read more >

Record Day for Bitcoin Spot ETFs: $1.36 Billion Inflows

The day after the U.S. Presidential election saw a record-breaking net inflow of $1.36 billion into Bitcoin Spot ETFs, pushing their AUMto new heights.

Read more >

UBS Launches uMINT, its First Tokenized USD Money Market Fund

UBS Asset Management announced the launch of uMINT, a Money Market Fund, making a move to join other major institutions within the tokenized US Treasury market.

Read more >

Spiko Reaches $100m AUM Milestone, Set for Deployment on Arbitrum

Spiko's USD and EUR Money Market Funds attract inflows, reaching $113 million in assets under management. On-chain activity suggests an upcoming deployment on Arbitrum One.

Read more >

Hashnote Gains Momentum as Institutions Choose USYC for Collateral

Hashnote's USYC, is gaining traction among major digital asset firms, with institutional trading venues integrating it as a yield-bearing collateral. Its growth is boosted by Usual's stablecoin.

Read more >

Readi explains Tokenization on the Smart Patrimoine show

Discover Alexis Bourdillat's, co-founder of Readi, insights on asset tokenization in the "Echo des Cryptos" rendez-vous of the Smart Patrimoine show on B SMART.

Read more >

Readi Joins Adan to Accelerate Tokenization Adoption

The French association brings together 200 professionals from the blockchain ecosystem. Readi becomes a member of Adan and joins the working groups on tokenization.

Read more >

Anemoy's Tokenized Money Market Fund as Collateral to Borrow USDC on Morpho

Investors in Anemoy's Money Market Fund, verified by Coinbase, can borrow a permissioned version of Circle's USDC on the Base layer 2.

Read more >

Readi Presents Tokenization Trends at the Khiplace Festival

Readi will be participating in the "New Generation of CIOs" track on innovation at the Khiplace Festival on Thursday, September 5, in Boulogne-Billancourt.

Read more >

Tokenization platforms and digital asset issuers can manage their profile on Readi

By claiming their company profile in just 2 minutes for free, real world asset issuers can edit the information displayed to investors and increase their audience.

Read more >

Readi launches a data analytics platform for tokenized assets

Readi provides investor insights on real world assets. Discover an exhaustive database on financial assets tokenized on the blockchain.

Read more >

Readi's latest insights

We share digital asset market reports and analyze trends in real world asset tokenization. Follow our social media.

Our services

Advisory

We offer comprehensive answers for the tokenization of real world financial assets.

Our extensive dataset provides you with industry best practices.

Investors and Asset Managers

We perform due diligence on digital assets, platforms, and issuers.

We can assist you in understanding the regulatory framework of tokenized assets, obtaining a risk assessment audit of smart contracts, and understanding the structuring of financial products.

Token Issuers

We introduce you to the most reliable and pertinent actors in the tokenization industry to kickstart your digital assets journey. Follow the best practices and standards to reach your ideal clients.

Advisors and Solution Providers

We craft in-depth reports on the state of the tokenized assets market and technology, incorporating all the valuable information we collect during our due diligence.

Partners & Ecosystem

Collectively, we elevate industry standards to enable future applications of financial tokenization.

We are members of these professional associations and incubators.

Reach out to us for any partnership.

Alexis Bourdillat

Head of Research & Advisory

Meet the team

We bring together investment professionals with extensive experience in due diligence on traditional and alternative investments, along with data analysts and blockchain developers.

Contact us