Spiko Reaches $100m AUM Milestone, Set for Deployment on Arbitrum

Oct. 28, 2024

Continuous inflows in USTBL and EUTBL

Six months after launch, Spiko's carefully designed Money Market Funds have attracted $113 million in assets under management. The French start-up has captured the interest of European investors: EUTBL, a fund invested in French and German Treasury Bills, has gathered $72,9 million, while its second fund focused on US Treasury Bills, USTBL, has reached $40.5 million in AUM. Both strategies are experiencing steady growth, showing a strong interest from retail investors in risk-free returns.

A Fully-Compliant Strategy for Retail Investors and Fintechs

Spiko stands out in the tokenized Money Market Funds industry as the first European start-up to launch fully-compliant funds under the UCITS directive, with shares tokenized via a regulatory framework that allows distributed ledger technology as an official bookkeeper.

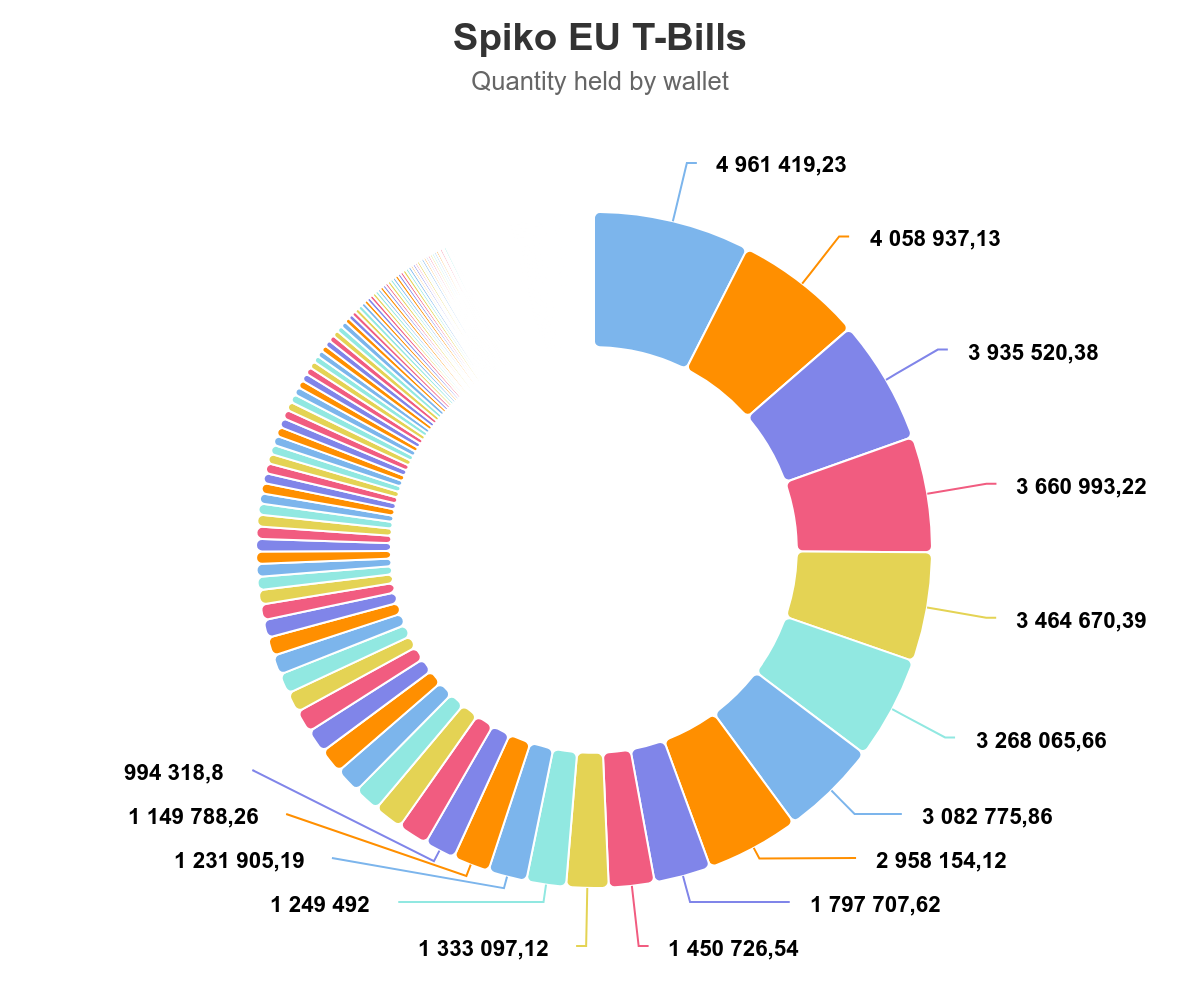

With 364 on-chain token holders in its EUTBL fund and no single investor holding more than 7.5% of shares, Spiko is applying a successful strategy by offering yield-bearing investments to retail investors, with a minimum investment of just $1,000.

This approach contrasts sharply with competitors like Hashnote US Yield Coin, which has a steep AUM growth tied to Usual's stablecoin at 93.5% of supply, and BlackRock USD Institutional Digital Liquidity Fund, which limits access to institutional investors with a $5 million minimum.

On-chain subscriptions with three stablecoins

In early summer, Spiko expanded accessibility for blockchain investors by enabling subscriptions with three stablecoins: DAI, USDT, and USDC. Spiko's technology facilitates stablecoin off-ramping and issues shares directly to investors' wallets.

Upcoming deployment on Arbitrum One

Spiko's EUTBL and USTBL are currently live on Ethereum Mainnet and Polygon. Recent on-chain and GitHub activity suggests that the funds will soon launch on the Arbitrum One network.

Readi has identified potential smart contract addresses for both funds, now visible on their product pages for EUTBL and USTBL.