Hashnote Gains Momentum as Institutions Choose USYC for Collateral

Oct. 27, 2024

Collateral Adoption by QCP and Deribit

In early October, Singapore-based QCP announced the incorporation of USYC as an approved collateral option, enabling clients to use USYC to back investments with QCP, including options, structured products, and yield-generating strategies.

Two days later, Hashnote announced the integration of USYC on the Deribit platform, allowing clients to generate yield on funds used as collateral for trading options and derivatives.

This adoption underscores a broader trend as institutional players seek yield-bearing solutions for managing collateral in their digital portfolios.

Fireblocks Off Exchange as an Alternative to Exchange Custody

Fireblocks has partnered with both QCP and Deribit to offer clients a flexible custody option for their collateral. Clients of the trading platform can now deposit their collateral in a Collateral Vault Account (CVA), which leverages MPC (Multi-Party Computation) technology to enable mutual control shared with the exchange.

Through Fireblocks Off Exchange secure-proof solution, exchanges use the vault's position to fund credit on client accounts. Deposits remain under joint control and are segregated in a self-custody vault.

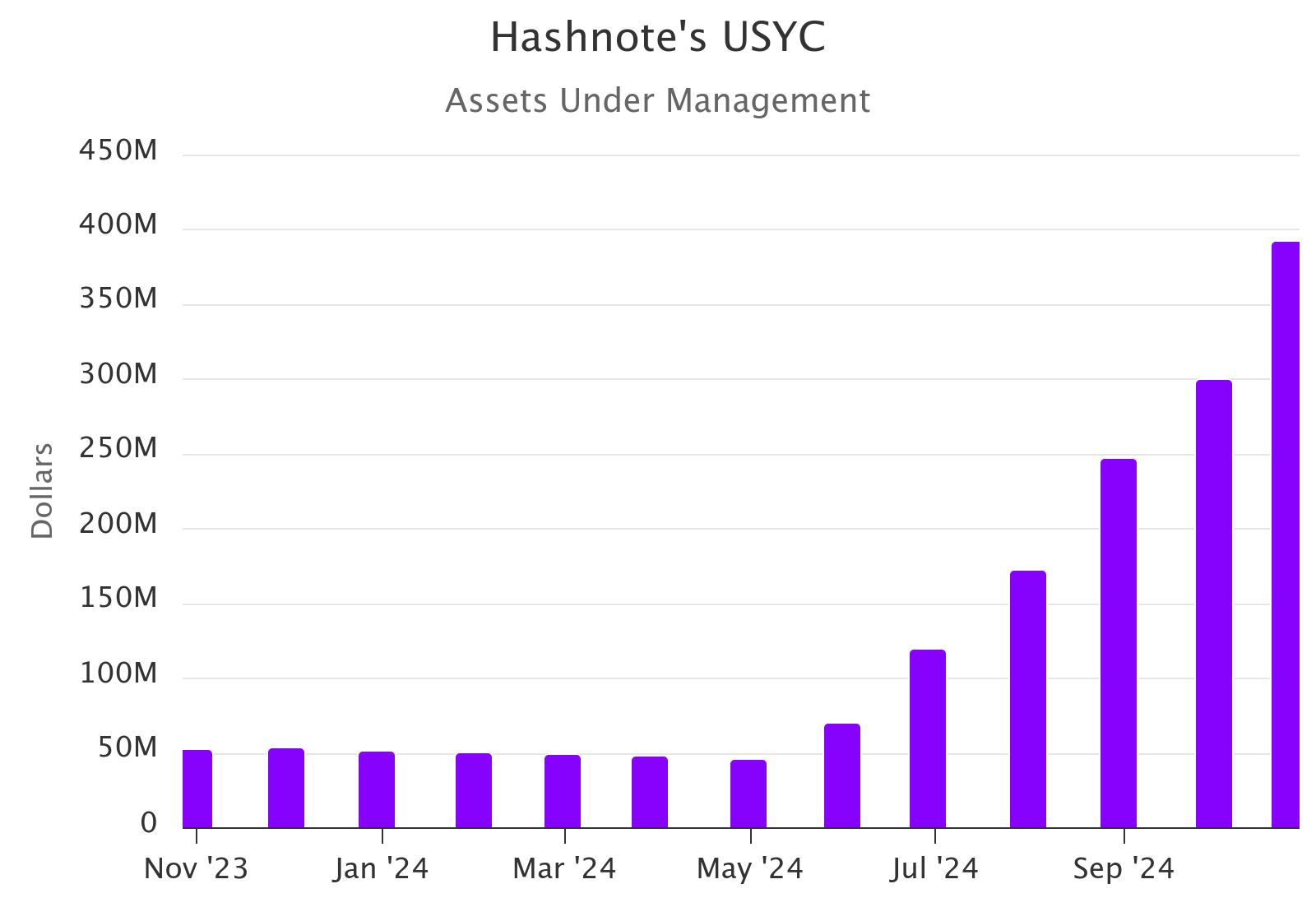

USYC's AUM Growth Tied to Usual's USD0

Hashnote's USYC assets under management (AUM) have surged within the Real World Assets Money Market segment, more than doubling to $393 million in the last quarter. This growth is closely tied to Usual’s USD0 stablecoin, which exclusively uses USYC as its approved collateral asset. As of October 27, 2024, Usual holds 93.4% of USYC’s outstanding supply, representing over $362 million, underscoring USYC’s rapid establishment as a significant collateral asset.