Anemoy's Tokenized Money Market Fund as Collateral to Borrow USDC on Morpho

Sept. 11, 2024

Two new vaults exposed to RWAs on Morpho

The Morpho decentralized finance infrastructure hosts two new vaults with similar process and features on the Base layer 2 blockchain: Steakhouse USDC RWA and RE7 RWA.

While it relies on a complex system of resource allocation, dynamically adjusted interest rates, and liquidation processes, the operation of a vault can be summarized for an investor as the deposit of a token that will be lent to other actors in exchange for collateral posting and interest payments.

The particularity of these two vaults: the deposited token is a permissioned stablecoin, it is lent against shares of a tokenized money market fund as collateral.

Anemoy Liquid Treasury Fund 1 as collateral

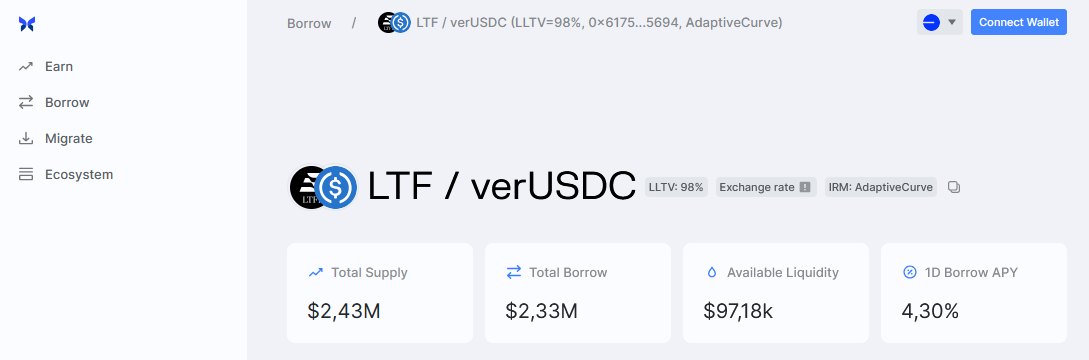

The Anemoy Liquid Treasury Fund 1 (LTF) tokenized on Centrifuge platform and managed by Anemoy is accepted as collateral on Morpho.

This means that fund investors can deposit their shares on the LTF / verUSDC liquidity pair of Morpho and borrow USDC if they have verified their wallet with Coinbase Verifications.

The total outstanding amount of $37 million of the Anemoy Liquid Treasury Fund is spread across 4 blockchains: Centrifuge, Celo, Ethereum, and Base. The amount issued on the Base blockchain, $4.5 million, was fully deposited as collateral on Morpho at the opening of the vault.

An entirely permissioned protocol with Coinbase Verifications

Holders of Anemoy Liquid Treasury Fund 1 have been authorized to invest by Anemoy during a KYC (Know-Your-Customer) check.

The verification system on the blockchain proposed by Coinbase makes it possible to pursue interactions with decentralized finance protocols between authorized actors.

Indeed, for each borrowing transaction on this liquidity pair, Circle's USDC is wrapped into a verUSDC token. For each transfer of this token to be effective, wallets must be registered on a list of authorized members, or have a verification attestation issued by Coinbase.

Coinbase customers can request verification of their wallet on the Coinbase Verifications page.

This collaboration between the largest players working with traditional investors is a true demonstration of the bridge to decentralized finance offered by the tokenization of financial assets. It is an example of composability, a term that describes the ability to use your tokenized asset on the blockchain to benefit from other financial services.

This initiative seals a significant milestone for these companies, which could deploy this type of solution on a larger scale.